This week, the operating rate of leading domestic downstream aluminum processing companies increased by 0.5 percentage points to 64.9% compared with before the holiday, and decreased by 0.2 percentage points compared with the same period last year.

By sector

The operating rates of the profile and cable sectors rebounded this week. Among them, the market pick-up volume of cables in the first half of the year was relatively tight, and the operating rate will remain at load before June. Following the State Grid orders, the market photovoltaic order pick-up has improved recently, and the weekly operating rate has increased slightly; the profile sector is due to the late resumption of work at downstream construction sites in Shandong Province, coupled with the pressure of delivery cycle. Recently, downstream construction profiles have been purchased in a rigid demand, and industrial profile companies that were previously constrained by high aluminum prices and slow production have gradually accepted aluminum prices above 20,000 after May, giving certain support to the operating rate of industrial profiles.

The operating rates of other sectors are mainly stable for the time being, downstream demand for plates, strips and foils remains strong, and the operating rates of leading companies mostly remain high; in contrast, demand for the alloy sector is relatively weak, and the operating rate is under upward pressure in the short term.

Overall, downstream aluminum consumption remains resilient, and the operating rates of cables, plates and strips and other sectors are expected to continue to run at high levels in May.

Primary aluminum alloy

The operating rate of leading primary aluminum alloy enterprises is still 50% this week. The alloy market is very stable this week. Leading enterprises maintain the current production rhythm, and downstream demand has not fluctuated significantly. In the future, some leading enterprises are expected to increase production in order to increase the proportion of aluminum alloying in the group, and the operating rate may move up.

Aluminum Strip

This week, the operating rate of leading aluminum sheet and strip enterprises is still 77%. At present, the overall market demand is still good, and the terminals are not tired. After the large enterprises lowered the processing fees, the order volume is mostly sufficient. However, the demand of terminal sectors such as construction still needs to be observed. A large number of new aluminum sheet and strip production capacity will be put into production soon, resulting in the aluminum sheet and strip market optimism is not strong, and the future operating rate will be weak.

Aluminum Cable

This week, the operating rate of leading aluminum cable companies increased by 0.6 percentage points to 65.2%. This week, the operating rate of leading aluminum cable companies performed steadily. Following the State Grid orders, the market photovoltaic order pick-up improved, and the weekly operating rate increased slightly. The company said that the market pick-up volume in the first half of this year was relatively tight, and it is expected that the operating rate will remain at a relatively high load before June. In addition, the current market procurement trend has changed. This year's conductor order demand is mostly high-conductivity, and the use of ordinary aluminum rods has decreased. This is reflected in the relative oversupply of ordinary rods in the aluminum rod market, and there is a lack of motivation for the increase in processing fees. Under the condition that the industry's pick-up volume remains stable, it is expected that the overall operating rate of domestic aluminum cable companies will remain high in May.

Aluminum Profile

This week, the operating rate of domestic aluminum profile enterprises continued to grow and rise, rising by 2.00 percentage points to 60.00% compared with before the May Day holiday. In terms of different sectors, the leading enterprises of building profiles have increased their orders on hand. According to SMM's research, due to the late resumption of work at downstream construction sites in Shandong and the pressure of delivery cycle, downstream enterprises have gradually purchased according to rigid demand. In the industrial profile sector, due to the high aluminum price in April, the downstream waited and slowed down production. In May, the terminal gradually accepted the aluminum price of more than 20,000, and some orders for production reduction in April were placed in May, which provided certain support for the operating rate of industrial profiles. Overall, the aluminum price remained above 20,000 in May, but the terminal acceptance improved and the rigid demand supported it, and the operating rate of leading domestic aluminum profile enterprises rebounded.

Aluminum foil

This week, the operating rate of leading aluminum foil enterprises remained stable at 77.3%. Recently, the demand for downstream sectors such as food packaging, air conditioners, and batteries has remained strong, and the operating rates of leading enterprises have mostly remained high. In May, some products are approaching the traditional off-season, and the demand for products such as air-conditioning foil is highly related to global weather. Whether the operating rate of leading aluminum foil enterprises can be maintained at a relatively high level in the future remains to be further observed.

Recycled aluminum alloy

This week, the operating rate of leading recycled aluminum enterprises remained stable at 59.8% compared with the pre-holiday period. During the May Day holiday, recycled aluminum plants basically stopped production for 0-3 days, and large plants resumed normal production this week. Driven by the rigid demand for replenishment of some downstream stocks after the holiday, the market transaction was still good during the week, but actual consumption has remained bleak since May, manufacturers have not been able to ship smoothly, and low-price competition is fierce, which has suppressed the operating rate of enterprises. In addition, the "reverse invoicing" policy may increase the tax burden cost of recycled aluminum plants, but since the policy was implemented not long ago, the specific details of local implementation have not yet been clarified, and all parties are still in the game stage. Overall, due to insufficient orders and the impact of the "reverse invoicing" policy on scrap aluminum procurement, the industry's operating rate is expected to be mainly reduced in May.

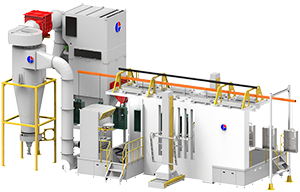

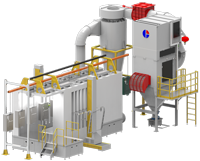

Automatic coating room

Automatic coating room Manual coating room

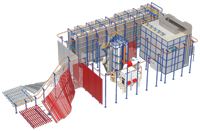

Manual coating room Engineering machinery coating room

Engineering machinery coating room Aluminum profile vertical spraying line

Aluminum profile vertical spraying line Automatic coating equipment

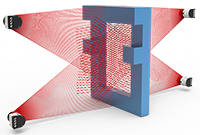

Automatic coating equipment Electrostatic powder coating gun

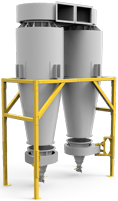

Electrostatic powder coating gun Recovery system

Recovery system Powder feeding system and new powder system

Powder feeding system and new powder system Dust explosion protection system

Dust explosion protection system Identification system and automation solution

Identification system and automation solution Hot cleaning furnace

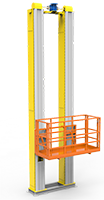

Hot cleaning furnace Lifting platform, mobile platform

Lifting platform, mobile platform