This week, the operating rate of leading domestic downstream aluminum processing enterprises remained stable at 64.9% compared with last week, an increase of 0.5 percentage points compared with the same period last year.

By sector

This week, the cable sector performed steadily with the support of State Grid and photovoltaic orders. The industry's shipments were at the peak season level. In addition, the recent aluminum prices were strong externally and weak internally, which boosted export orders and drove the industry's operations to rise slightly.

Constrained by high aluminum prices, the wait-and-see sentiment of the terminal has risen again. The opening of the profile sector was under pressure again this week. However, in the recent macroeconomic situation, there have been frequent positive news such as trillion-yuan treasury bonds, ultra-long-term treasury bonds, and the reduction of housing down payment ratios and provident fund loan interest rates. Some companies are waiting for their implementation. According to SMM's research, the stimulating effect of this round of favorable policies has begun to show. Some companies said that the collection of funds has improved and they look forward to the demand for subsequent orders. Leading companies in the plate, strip, foil and primary alloy sectors maintain stable production, but be wary of the subsequent weakening demand that will drag down the operating rate. The recycled alloy sector continues to be weak. Due to the obvious weakening of demand and profit compression, the operating rate of recycled aluminum plants has fallen slightly.

Overall, aluminum prices rose strongly again this week, and downstream aluminum companies re-emerged in a wait-and-see attitude. Coupled with the partial weakening of demand, the overall start-up was suppressed. In the short term, attention should be paid to the boost to exports under the situation of weak internal and strong external prices, as well as the implementation effects of policies such as real estate and "old for new".

Primary aluminum alloy

The operating rate of leading primary aluminum alloy enterprises is still 50% this week. Leading alloy enterprises continued their previous operating status this week, but downstream demand has begun to show signs of fatigue as the traditional peak season draws to a close. Some enterprises reported that the number of new orders has decreased month-on-month, and sales pressure has further increased. However, driven by the increase in the proportion of aluminum alloying in the group, some leading enterprises have not changed their expectations for future production increases, and the industry's operating rate is expected to continue to grow.

Aluminum Strip

This week, the operating rate of leading aluminum sheet and strip enterprises is still 77%. Recently, the overall market demand for aluminum sheet and strip is stable but weak. Leading enterprises have a relatively abundant order volume on hand and can maintain high-load production. However, many small and medium-sized enterprises have reduced their operating rates due to insufficient demand. The south has entered summer, and terminal demand such as construction has been suppressed. Short-term demand is expected to shrink, and the operating rate of the entire industry will also decline. The operating rate of leading enterprises will remain stable for a longer period of time.

Aluminum Cable

This week, the operating rate of leading aluminum cable companies increased by 0.8 percentage points to 66%, mainly because the leading companies in Jiangsu have performed well in recent aluminum wire exports, driving the operating rate up slightly. Supported by State Grid and photovoltaic orders, the operating rate of leading aluminum cable companies this week remained stable, and the industry's shipments remained stable at the peak season level. The base price of aluminum continued to rise during the week, and the downstream was suppressed by high aluminum prices. The general pole market transaction was not good, but the market demand for high-conductivity rods was still good. In addition, due to the recent strong external and weak internal aluminum prices, companies said that the proportion of export orders has increased, providing support for the industry's operating rate. Combined with the company's order scheduling, it is expected that the overall operating rate of domestic aluminum cable companies will remain high in May.

Aluminum Profile

This week, the overall operating rate of domestic aluminum profile enterprises remained stable, recording 60.00%. In terms of sectors, the demand for building profiles has shown a downward trend, mainly due to the high aluminum prices, and the wait-and-see sentiment of the terminal has risen again. According to SMM research, only a few leading building materials factories received a small number of new orders this week, and most building profiles are under great sales pressure. In addition, in the recent macro-economic situation, there have been frequent good news about trillion-yuan treasury bonds and ultra-long-term treasury bonds, and some companies are waiting for their implementation. According to SMM research, the stimulating effect of this round of favorable policies has begun to show, and some companies have said that the collection of funds has improved, and they look forward to the demand for subsequent orders. The industrial profile sector is running steadily as a whole, and the terminal purchases are mainly based on rigid demand, and there are no new highlights. Overall, the high aluminum price has limited the increase in demand to a certain extent. Supported by rigid demand, the leading domestic aluminum profile companies have maintained a stable operation, and the promotion of favorable policies needs to be continuously tracked in the future.

Aluminum foil

This week, the operating rate of leading aluminum foil enterprises remained stable at 77.3%. The downstream market fluctuated slightly during the week, and the demand for various aluminum foil products was relatively stable. However, with the arrival of summer, there is a certain degree of uncertainty in the demand for products such as air-conditioning foil and food packaging foil. Although the operating rate of leading enterprises can be maintained at a high level in the short term, we still need to be vigilant about the risk of insufficient demand suppressing the operating rate in the long term.

Recycled aluminum alloy

This week, the operating rate of leading recycled aluminum enterprises fell by 0.5% from last week to 59.3%. Halfway through May, the terminal consumption of recycled aluminum alloys is still not ideal, and the company's shipments continue to decline compared with April. The orders of alloy factories mostly rely on long-term orders from downstream or rigid demand, and the sales pressure is relatively large. Due to insufficient orders, manufacturers continue to grab orders at low prices, making it difficult for market prices to rise. Due to the obvious weakening of demand and profit compression, the output of recycled aluminum plants has been reduced accordingly, and the operating rate in May is expected to continue the decline in April.

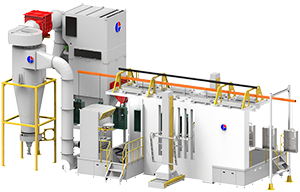

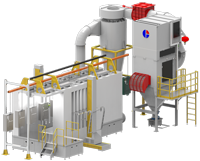

Automatic coating room

Automatic coating room Manual coating room

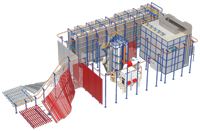

Manual coating room Engineering machinery coating room

Engineering machinery coating room Aluminum profile vertical spraying line

Aluminum profile vertical spraying line Automatic coating equipment

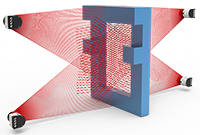

Automatic coating equipment Electrostatic powder coating gun

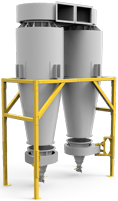

Electrostatic powder coating gun Recovery system

Recovery system Powder feeding system and new powder system

Powder feeding system and new powder system Dust explosion protection system

Dust explosion protection system Identification system and automation solution

Identification system and automation solution Hot cleaning furnace

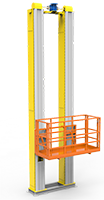

Hot cleaning furnace Lifting platform, mobile platform

Lifting platform, mobile platform