On May 14, the United States announced the results of the four-year review of the "301" additional tariffs on China, raising the tariff rate of aluminum products with an additional tariff rate of 0% or 7.5% under the "301" measure to 25%. At this point, the additional tariff rate for aluminum products (HS Chapter 76) covered by the "301" measure may rise to 25%. In 2023, China exported a total of 693,000 tons of aluminum products to the United States, of which 232,000 tons were subject to a "301" additional tariff of 25%; another 461,000 tons were subject to a "301" additional tariff of 0% or 7.5%, which may all be raised to 25% this time. At the same time, the United States has also implemented a large-scale anti-dumping and "232" measures on Chinese aluminum products, with multiple tax rates superimposed and the highest sanction rate exceeding 400%, exposing the nature of U.S. trade bullying.

Review of "301" sanctions: the trade sanctions with the widest product coverage currently being implemented by the United States

On August 18, 2017, the Office of the United States Trade Representative (USTR) officially launched a "301" investigation into China in the areas of technology transfer, intellectual property rights and innovation in accordance with Section 301 of the Trade Act of 1974.

On March 22, 2018, USTR released the results of the "301" investigation and gradually imposed high tariffs of varying amounts on Chinese goods.

On April 23, 2018, USTR announced a list of additional tariffs on $50 billion worth of Chinese goods (divided into $34 billion and $16 billion lists), and subsequently implemented a 25% tariff increase.

On July 10, 2018, USTR announced a list of $200 billion worth of Chinese goods to be subject to additional tariffs, and subsequently implemented a 25% tariff increase.

On May 17, 2019, USTR announced a list of $300 billion worth of Chinese goods for additional tariffs, and subsequently announced a 15% tariff increase; on February 14, 2020, the tariffs on $300 billion List A goods were reduced from 15% to 7.5%; the 15% tariff on $300 billion List B goods was not implemented.

On May 3, 2022, USTR initiated the sunset review procedure for the U.S. “301” measures against China.

"301" aluminum-related products

The list of goods worth 50 billion US dollars: There are 4 products directly related to aluminum. The first list of goods worth 34 billion US dollars includes aluminum foil for aluminum electrolytic capacitors (HTS 8532.22.00); the second list of goods worth 16 billion US dollars includes two types of aluminum cables (HTS 7614.10.10 and 7614.90.20) and a type of product directly using aluminum materials - heat exchangers containing brazed composite aluminum rolled materials (HTS 8419.60.10).

US$200 billion list: Aluminum-related products cover the upstream and downstream of the aluminum industry chain, including aluminum scrap (7602.00.00), aluminum powder (7603.10.00 and 7603.20.00) and some aluminum products (7610-7616).

The $300 billion list is divided into List A and List B. List A refers to products with a import share of less than 75% from China, and List B refers to products with a import share of ≥ 75% from China. The tariff on goods on List A was reduced from 15% to 7.5% in February 2020, and several exemption lists have been issued since then; the tariff on goods on List B has not been implemented.

Sino-US aluminum product trade pattern

The United States is the country that has launched the most trade investigations and sanctions against China. Since 2017, the United States has launched intensive trade sanctions on aluminum and related products imported from my country for various reasons, among which the most influential ones include anti-dumping and anti-subsidy, "332", "232" and "301", with multiple tariffs superimposed and implemented.

In recent years, most of China's aluminum exports to the United States have been subject to anti-dumping and countervailing sanctions and extremely high tax rates, so the export volume has dropped significantly. Since 2018, China's exports of aluminum and aluminum products (under HS7601-7608) to the United States have dropped to 200,000-350,000 tons, accounting for about 4% of China's total exports. Compared with 2017, the decline in 2023 reached 35%. However, China's exports to the world have generally increased, with a compound annual growth rate of 2.9% from 2018 to 2023.

China's exports of aluminum products to the United States (under HS7609-7616) remain at 360,000-570,000 tons, accounting for about 20% of China's total exports; exports to the United States are generally stable, with an annual compound growth rate of 3.8% from 2018 to 2023, lower than the average growth rate of exports to the world.

Impact of trade sanctions

Before the increase in the additional tax, most aluminum products and some aluminum materials had been subject to a 25% "301" additional tariff, including aluminum powder (7603), aluminum structures (7610.90), aluminum containers (7611, 7612, 7613), aluminum strands (7614), household aluminum appliances and parts (7615.20), and other aluminum products (7616). In 2023, China exported 232,000 tons of products with a 25% "301" additional tariff to the United States, accounting for 33.5% of its total exports to the United States.

According to the description, it is speculated that the products involved in this additional tariff increase mainly refer to the fourth batch of "301" measures, that is, the goods in the $300 billion list with an additional tariff of 0% or 7.5% (the specific results will be announced after soliciting opinions). Including all aluminum and aluminum products except scrap aluminum (7602) and aluminum powder (7603), that is, unwrought aluminum and aluminum alloys (7601), aluminum bars and profiles (7604), aluminum wire (7605), aluminum plates and strips (7606), aluminum foil (7607), aluminum tubes (7608); and some aluminum products, including aluminum pipe accessories (7609), aluminum structures (7610.10), and household aluminum appliances and parts (7615.10). In 2023, China will export 461,000 tons of the above products to the United States, of which 226,000 tons are aluminum products and 235,000 tons are aluminum.

Data source: General Administration of Customs, Antaike

For a long time, China's aluminum industry has been based on domestic demand and promoting the high-quality development of the global aluminum industry chain and supply chain as its core goals. The export volume of aluminum and aluminum products has remained at a high level for many years, reflecting the resilience and international competitiveness of China's aluminum product trade in maintaining the stability of the global supply chain. Playing an important role. At present, the global economy is still facing great pressure. The continued high inflation level in the United States has had a serious impact on American consumer confidence. The continuous imposition of tariffs on imported goods will undoubtedly increase the burden on consumers and further stimulate consumer pessimism. In addition, these measures will also disrupt the global supply chain system. In an environment where crises and pressures coexist, countries should maintain similarities and abandon differences, expand and deepen mutually beneficial economic and trade cooperation, and reshape a global economic and trade system of co-governance, sharing and win-win.

Attached

The "301 investigation" is an investigation conducted by the United States under the "301 clause". Section 301 of the U.S. Trade Reform Act of 1974 authorizes the Office of the United States Trade Representative and the President to investigate and impose sanctions on unreasonable or unfair trade practices of foreign governments upon complaint or at their own discretion, hence the name "301 investigation". The law has been amended many times, the most recent being the "Omnibus Trade and Competitiveness Act of 1988".

According to the "Section 301", USTR can initiate investigations into the "unreasonable or unfair trade practices" of other countries and negotiate with the governments of relevant countries. After the investigation and consultation, it can recommend to the US President to initiate unilateral, compulsory retaliatory measures, including revoking trade preferences, imposing retaliatory tariffs, restricting imports, and suspending relevant agreements.

The basic procedure of "301 investigation" is: after USTR initiates 301 investigation, it shall conduct bilateral consultations with the government of the investigated country and request the government of the investigated country to cancel the relevant unreasonable or unfair trade practices; if no agreement can be reached, retaliatory measures may be taken against the investigated country. If the investigation does not involve a trade agreement, USTR shall end the consultation within 12 months and decide whether to impose trade sanctions; if the investigation involves a trade agreement, under certain specific conditions, USTR shall immediately request to enter the dispute settlement procedure stipulated in the agreement.

Reprinted from: Aluminum Screen

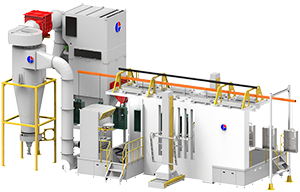

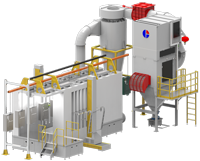

Automatic coating room

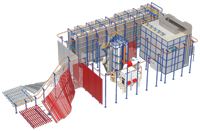

Automatic coating room Manual coating room

Manual coating room Engineering machinery coating room

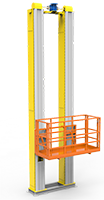

Engineering machinery coating room Aluminum profile vertical spraying line

Aluminum profile vertical spraying line Automatic coating equipment

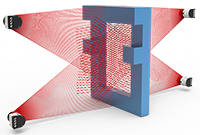

Automatic coating equipment Electrostatic powder coating gun

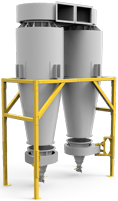

Electrostatic powder coating gun Recovery system

Recovery system Powder feeding system and new powder system

Powder feeding system and new powder system Dust explosion protection system

Dust explosion protection system Identification system and automation solution

Identification system and automation solution Hot cleaning furnace

Hot cleaning furnace Lifting platform, mobile platform

Lifting platform, mobile platform