A high-profile battle for aluminum metal stocks has taken place at the London Metal Exchange (LME), with the protagonists being Trafigura, a world-renowned commodity trading giant, and Wall Street investment banks and hedge funds including Squarepoint Capital, Citigroup and JPMorgan Chase.

On May 25, according to media reports, Trafigura has delivered a large amount of aluminum metal to LME in recent weeks, suggesting its pessimistic expectations for the future trend of aluminum prices. But at the same time, Wall Street institutions including Squarepoint Capital and Citigroup have begun to buy these aluminum stocks, betting on the expectation of rising aluminum prices.

As aluminum stocks may become tight in the future, the market is currently competing fiercely for this batch of aluminum stocks worth more than US$1 billion, which has even changed the global aluminum stock pattern. Who will have the last laugh?

Is a short squeeze in the aluminum market imminent?

Trafigura has built up a large stockpile of aluminum in Port Klang over the past year, partly because of large contracts with Indian suppliers such as Vedanta. Typically, traders who have built up large stocks see an opportunity to profit from the physical premiums buyers pay over the London Metal Exchange price. When demand outstrips supply, premiums at specific locations tend to rise as physical consumers of aluminum extract metal from stockpiles.

However, in the past two weeks, Trafigura suddenly registered about 650,000 tons of aluminum to the LME, causing a surge in the number of warehouse certificates, which was the largest single-day registration action in 27 years.

Trafigura's move appears to be based on its bearish view on future aluminum prices, while other market participants hold the opposite view and quickly purchase the aluminum metal and apply for withdrawal.

The view of aluminum bulls is gradually gaining more and more support: LME investors, who were generally bearish on aluminum prices in mid-March this year, have now turned bullish, with expectations of rising aluminum prices reaching the highest level in two years. The main reason behind this is that the market is expected to face tight supply in the second half of this year due to global production constraints and expected demand growth driven by China and India.

But Trafigura’s decision to move a large amount of its stock to the LME has puzzled many of its aluminium market rivals. With physical market trading weak, Trafigura may have decided that selling the metal on the LME and collecting some of the storage fees from future owners was the quickest and most profitable way to make a profit.

However, the market situation has become more complicated as the LME introduced rules to limit inventory backlogs and long queues at Port Klang have caused some buyers to withdraw their withdrawal applications.

So far, traders bullish on aluminum have the upper hand. LME aluminum prices have risen about 4% since Trafigura began deliveries. Aluminum prices hit a 23-month high on Tuesday after Rio Tinto Group declared force majeure on shipments from two alumina plants in Australia.

A historic short squeeze in the copper market

In addition to the aluminum market, the copper market had also been forced into a short squeeze.

On May 15, media reported, citing people familiar with the matter, that commodity trading giant Trafigura and IXM, a subsidiary of China Molybdenum Co., Ltd., are trying to buy physical copper to deliver their large short positions on the CME exchange in the United States.

Trafigura and IXM held a large number of short positions in the COMEX (affiliated with CME Group) copper market, which means they were betting on a fall in copper prices or hedging their own price risk exposure. However, they did not expect that the COMEX copper price would suddenly surge from Tuesday, causing these short positions to be severely "shorted".

By May 20, COMEX copper prices hit a record high of $5.196 per pound, a 33.5% surge this year. As of press time, COMEX copper prices have fallen to $4.759 per pound.

Reprinted from: Aluminum Screen

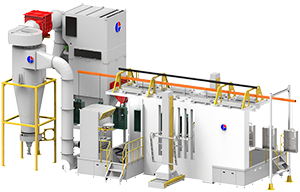

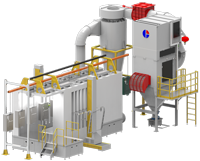

Automatic coating room

Automatic coating room Manual coating room

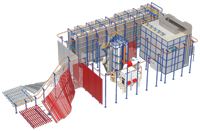

Manual coating room Engineering machinery coating room

Engineering machinery coating room Aluminum profile vertical spraying line

Aluminum profile vertical spraying line Automatic coating equipment

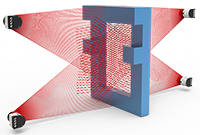

Automatic coating equipment Electrostatic powder coating gun

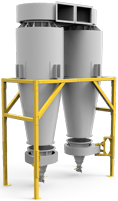

Electrostatic powder coating gun Recovery system

Recovery system Powder feeding system and new powder system

Powder feeding system and new powder system Dust explosion protection system

Dust explosion protection system Identification system and automation solution

Identification system and automation solution Hot cleaning furnace

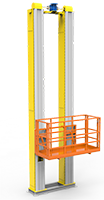

Hot cleaning furnace Lifting platform, mobile platform

Lifting platform, mobile platform